Demystifying the Finances Behind Adoption

As a proud adoptee and adoptive parent, I often hear people say “I would love to adopt but I could never afford it”. Recently, another financial planner friend of mine, reached out to see if I would be willing to speak with one of her clients about the finances of adoption and I thought to myself, There is so much misinformation around the finances of adoption, I want to shed a little light on the actual facts

We’re going to cover everything from the types of adoption and the cost associated with each, taxes and also other adoption assistance programs that may be available to you depending on the state you live in.

Types of Adoption:

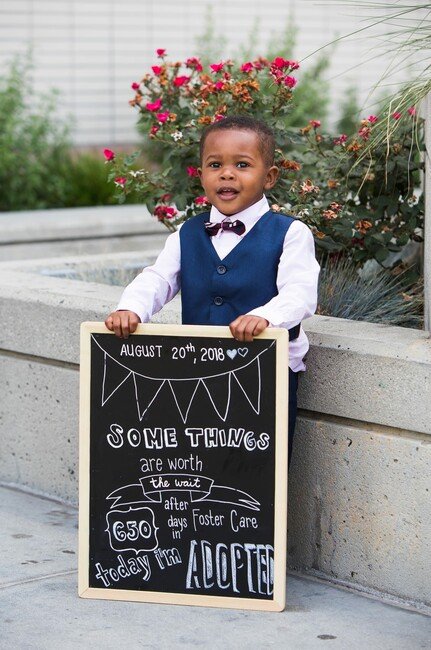

Public (also known as foster-to-adopt)- Our son Theodore was adopted through the Los Angeles County Dept of Child and Family services. So we were foster parents first, before we could call it official. Here’s a definition of Foster-to-adopt from consideringadoption.com. “What does foster-to-adopt mean? In a foster-to-adopt situation, prospective parents become a foster family in the hopes that one day they will be able to adopt their foster child(ren). In this situation, an adoption can only occur if and when the birth parents’ parental rights have been terminated. Every state has its own requirements for parents who wish to adopt a foster child so be sure to take a look at those to learn more about foster-to-adopt requirements in your area.”

Domestic Private Adoption - Domestic adoption (or private domestic adoption) refers to U.S.-born infants being placed for adoption by their birth parents, many times these parent will choose the adoptive parents and more often than in the past it means there’s an option for an open adoption where birth parents may be able to continue to play a role in your child’s life.

International Private Adoption: International adoption is a type of adoption where an individual or couple becomes the legal and permanent parent of a child who is a national of a different country. I was part of the first wave of international adoptions to the US that happened in the late 70’s and early 80s. My parents adopted me from South Korea. When I went to Korea in my early 30's for the first time, I saw my adoption records and the notes shocked me, they said that my Dad's income was $50,000 that year and my adoption cost $25,000! I was completely blown away by how expensive that was. International adoption is a type of adoption in which an individual or couple becomes the legal and permanent parent of a child who is a national of a different country.

COST:

Public (also known as foster-to-adopt)- Foster to adopt has cost as little as $0 in many states, who cover the costs of home studies, legal fees and even offer a monthly stipend for the care of the child while in foster care.

Domestic Private Adoption: An independent adoption can cost $15,000 to $40,000, according to the Child Welfare Information Gateway, a federal service. These fees cover a range of expenses including a birth mother’s medical expenses, legal representation for adoptive and birth parents, court fees, and social workers

International Private Adoption: According to consideradotpion.com The average cost range for international adoptions is $20,000-$40,000

Are there other ways to offset the costs of adoption? Yes, absolutely and I’m going to go over three. First, we have good old Uncle Sam and this offset comes in the form of a tax Credit. You should also know what the adoption assistance programs are for your state, county and city. For example: when our son was in foster care, before his official adoption, LA County paid for his daycare. Now I don’t know about you, but here in LA that amounted to about $1200/mo. Lastly, some companies (mostly large ones) offer adoption assistance for their employees, and some of these companies can be very generous and offer up to $25,000 in reimbursements!

TAX CREDITS:

Currently the IRS has a generous tax credit that can be used to offset taxes owed. You can read more about the credit directly on the IRS website, but here are a few highlights. https://adoption.com/adoption-tax-credit-guide and

https://www.irs.gov/newsroom/understanding-the-adoption-tax-credit

The maximum adoption credit taxpayers can claim on their 2021 tax return is $14,440 per eligible child.

There are income limits that could affect the amount of the credit

An eligible child must be younger than 18. If the adopted person is older, they must be unable to physically take care of themselves.

This credit is non-refundable. This means the amount of the credit is limited to the taxpayer's taxes due for 2021. Any credit leftover from their owed 2021 taxes can be carried forward for up to five years.

STATE ADOPTION ASSISTANCE PROGRAMS:

https://nacac.org/help/adoption-assistance/adoption-assistance-us/state-programs/

COMPANIES THAT OFFER ADOPTION ASSISTANCE:

https://adoption.com/8-companies-with-the-best-adoption-benefits/

So, why do I share all of this? I want people and families to understand that there are so many ways to grow your family. Adoptions has been a blessing in my families legacy for more than just one generation now. My hope is that this piece on the dollars and cents of adoption gives you the hope you the information you need to keep your hearts open!

-Laurie Allen-Raymond

Sources:

https://adoption.com/adoption-tax-credit-guide

https://www.irs.gov/newsroom/understanding-the-adoption-tax-credit

https://nacac.org/help/adoption-assistance/adoption-assistance-us/state-programs/

https://adoption.com/8-companies-with-the-best-adoption-benefits/

https://builtin.com/companies/perks/adoption-assistance

https://www.childwelfare.gov/pubPDFs/s_costs.pdf

https://www.irs.gov/taxtopics/tc607

https://www.adoptuskids.org/adoption-and-foster-care/how-to-adopt-and-foster/state-information